multistate tax commission allocation and apportionment regulations

Adopted February 21 1973. Allocation and Apportionment Regulations.

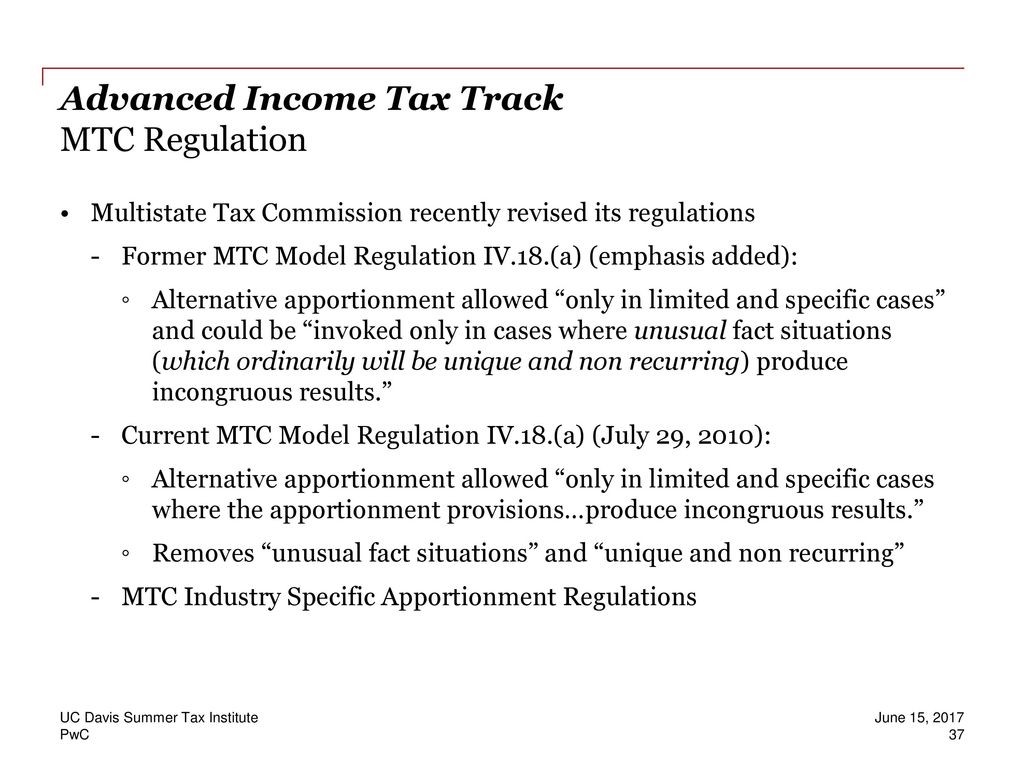

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

This rule is intended as an interpretive guideline in the application of Article VI of the Multistate Tax Compact section 32200 RSMo implemented by.

. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General Allocation and Apportionment. Multistate Tax Commission Allocation and Apportionment Regulations as adopted February 21 1973 and revised through July 29 2010To help determine whether a group of affiliated. Technical review of partnership and corporate state and local tax returns with attention to multistate tax issues.

Potential Tax Pitfalls Attorneys also need to carefully draft tax-apportionment clauses to take into account the impact of how estate and inheritance taxes are allocated and come up with a plan. In a rare special meeting on February 24 2017 the Multistate Tax Commission MTC adopted amendments to the MTCs Model General. 1 See Resolution Adopting Amendments to the Multistate Tax Commissions Model General Allocation and Apportionment Regulations Special Meeting of the MTC February 24 2017 a.

2 Applicability and Scope of Rule. Multistate consulting and compliance services including. Comeau In recent years states have.

2 a and Commission Bylaw 7 c this is to notify you that. Pursuant to the Multistate Tax Compact Art. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

To participate by telephone dial 1-719-457-1414 access code 258090. As revised through July 29 2010 Applicable to Article IV of the Multistate Tax Compact and to the Uniform Division of. On February 24 2017 the Multistate Tax Commission adopted amendments to its Model General Allocation and Apportionment Regulations.

Noonan and Paul R. 48 State Tax Notes 1063 June 30 2008 Multistate Taxation of Stock Option Income -- Time for a National Solution. For apportionment and allocation of net income for financial institu tions with the exceptions that the definition of financial institu tion in the appendix to the recommended formula is advisory.

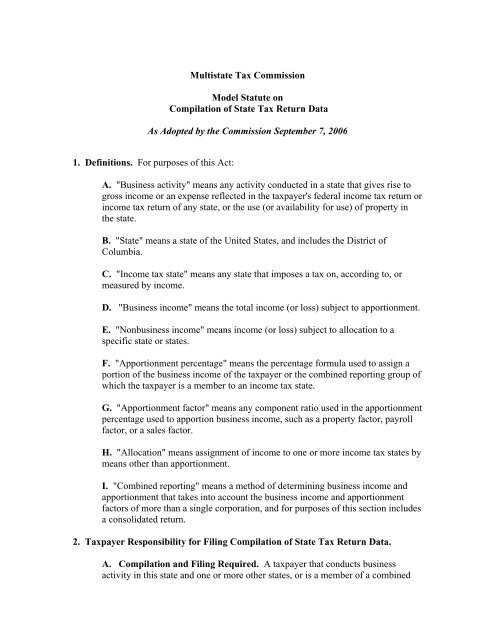

Application of the apportionment and allocation provisions of Article IV of the Multistate Tax Compact. The amendments to the model. Multistate Tax Commission Model General Allocation and Apportionment Regulations Current as of 2017 2 PREFATORY NOTES These prefatory notes and the drafters notes below are.

USA February 28 2017. These Regulations are intended to set forth rules concerning the.

Draft Regulation Multistate Tax Commission

Multistate Tax Commission Home

Vermont Clarifies Corporate Income Tax Apportionment Rules

Podcast Apportionment Sourcing What You Need To Know Pkf Mueller

Draft Model Uniform Statute On Multistate Tax Commission

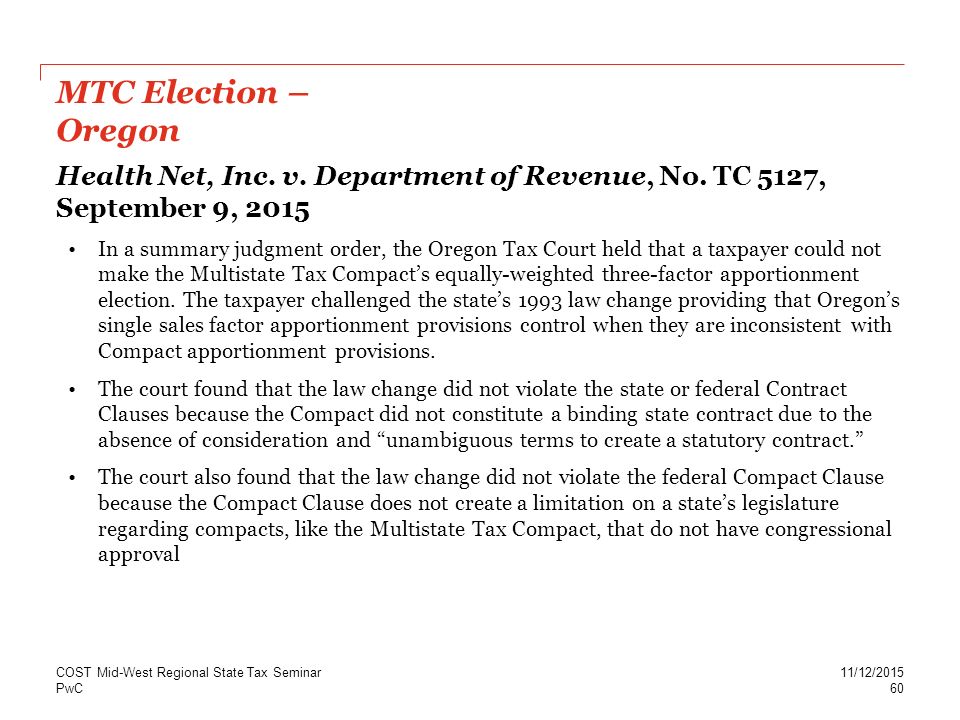

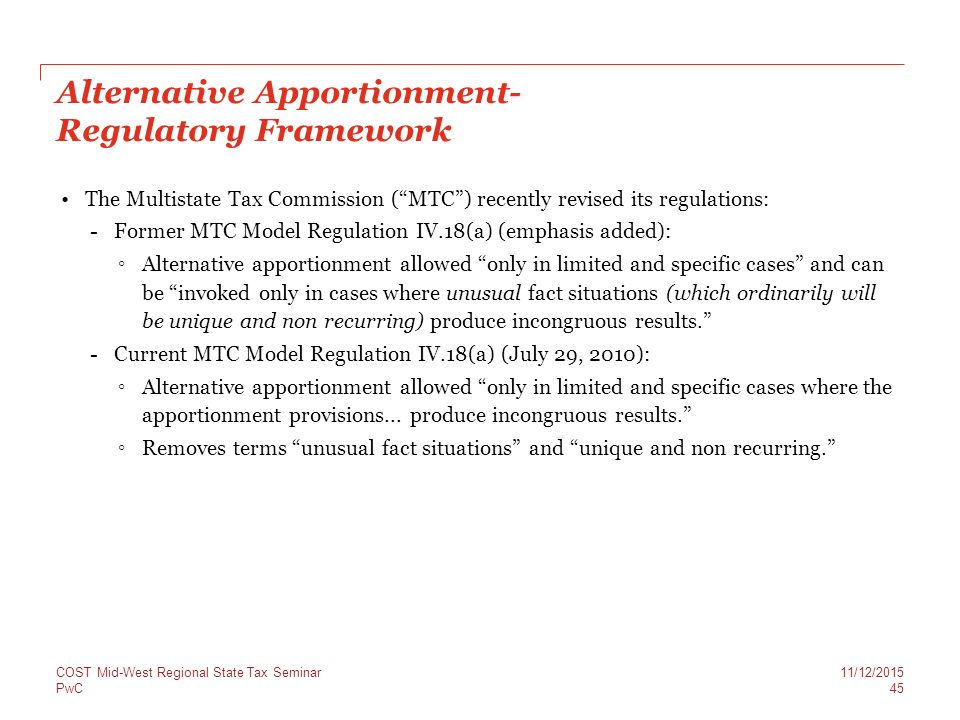

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download

Usa State Local Tax Top Stories Of 2015

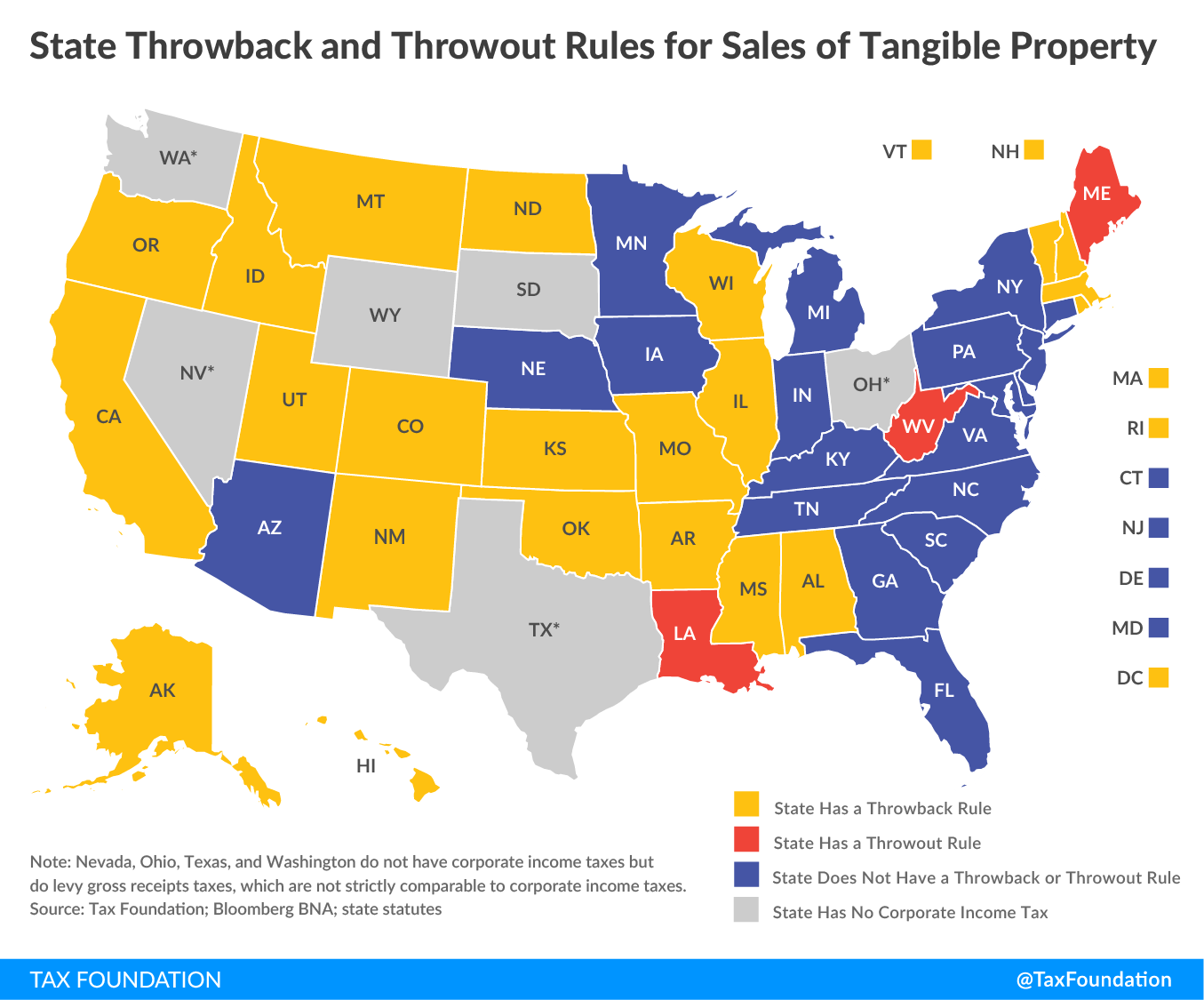

State Throwback Rules And Throwout Rules A Primer Tax Foundation

The Significance Of The Multistate Tax Compact And Uditpa Amid Recent Developments Accountingweb

Pdf Salt Useful Information Howard Hughes Academia Edu

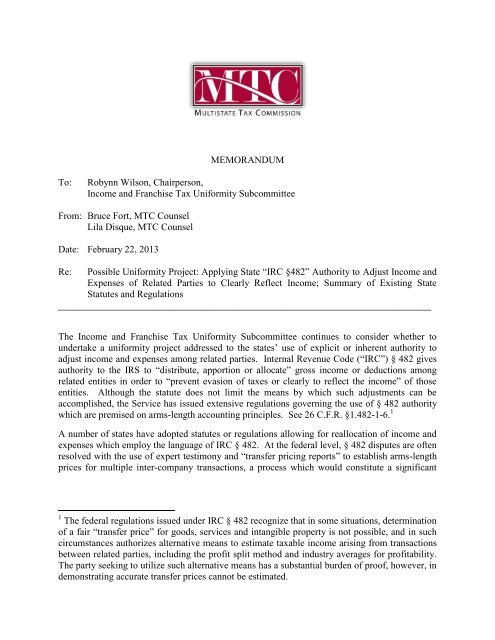

Memorandum To Multistate Tax Commission

Latest Developments In Sales Factor Trends Including Market Based Sourcing Cost Mid West Regional State Tax Seminar November 12 2015 Maureen Ppt Download

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download

Multistate Tax Commission With Helen Hecht Taxops

Acct 4400 Salt 2 Apportionment Multijurisdictional Tax Issues Uses Of Local State Taxes Acct 570 Ch 12 State Local Taxes 4400 Multi Jurisdictional Tax State And Local Taxation Tax Law Test

Multi State Sales Apportionment For Income Tax Reporting Withum

Uc Davis Summer Tax Institute Advanced Income Tax Track Ppt Download